Analyze Real Estate Investments Like a Pro and Maximize Returns

Go beyond simple cash flow analysis with advanced real estate metrics, tax strategies, and long-term projections. Factor in standard vs. cost segregation depreciation, passive losses, and tax impacts. Compare real estate vs. stock investments, project returns up to 50 years, and generate professional reports to refine your strategy.

Comprehensive Investment Breakdown

Real Estate vs. Stock Market Comparison

Depreciation & Tax Impact Analysis

Detailed PDF Reports & Unlimited Property Saves

Analyze Real Estate Investments Like a Pro and Maximize Returns

Go beyond simple cash flow analysis with advanced real estate metrics, tax strategies, and long-term projections. Factor in standard vs. cost segregation depreciation, passive losses, and tax impacts. Compare real estate vs. stock investments, project returns up to 50 years, and generate professional reports to refine your strategy.

Comprehensive Investment Breakdown

Real Estate vs. Stock Market Comparison

Depreciation & Tax Impact Analysis

Detailed PDF Reports & Unlimited Property Saves

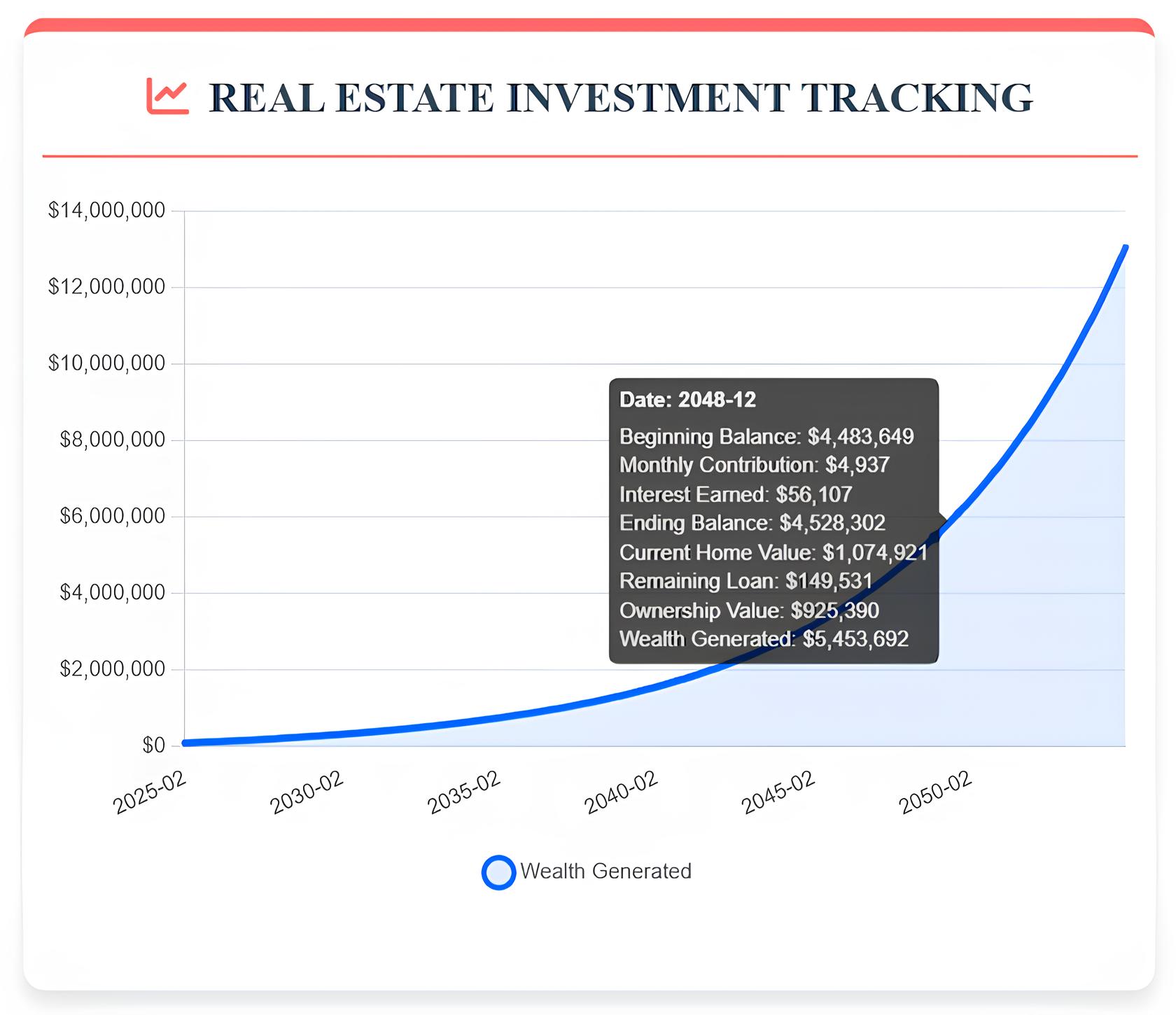

Track Your Investment Growth with Detailed Projections

Gain a comprehensive understanding of your real estate investment with key performance metrics, including cash-on-cash return, cap rate, monthly cash flow, net operating income, gross rent multiplier, break-even date, and more. Beyond these essential figures, the calculator also projects real estate investment growth over time, displaying long-term wealth generation through interactive charts and detailed breakdown tables.

Compare Real Estate Investments to Alternative Options Like Stocks

Visualize the long-term growth of alternative investments, such as the stock market, and evaluate the potential returns if you choose to invest in an alternative asset instead of real estate. This calculator also provides detailed projections comparing real estate investment growth against alternative options, giving you a clear perspective on which strategy is more profitable and results in maximum wealth generation relative to the total cash invested.

Track Rental Cash Flow & Tax Impact Over Time

Gain a clear, year-by-year breakdown of your rental property’s financial performance. This calculator details rental income, operating expenses, mortgage payments, and cash flow projections to help you assess long-term profitability. It also offers a comprehensive tax analysis of your rental income, breaking down deductions, depreciation, passive losses, and taxable rental income—providing critical insights to support informed investment decision-making.

Comprehensive Investment Performance Metrics

Evaluate your rental property's financial potential with detailed calculations of key investment indicators. Our Calculator provides a detailed, year-by-year breakdown of cash-on-cash return, capitalization rate, gross rent multiplier, and loan-to-value ratio, offering a comprehensive view of your property's financial performance.

Comprehensive Cost Analysis and Forecasting

Gain a clear understanding of your real estate investment costs with detailed breakdowns. This calculator provides cumulative cost projections over the entire analysis period, annual cost summaries, and in-depth monthly expense breakdowns—helping you manage expenses effectively and refine your investment strategy.

Mortgage Optimization and Extra Payment Strategies

Take control of your mortgage by exploring different extra payment scenarios. Our calculator allows you to model various extra principal payments, revealing how they can shorten your loan term and reduce total interest paid. Gain deeper insights with interactive amortization charts and tables that clearly illustrate your mortgage progress, breaking down every aspect of your payment strategy.

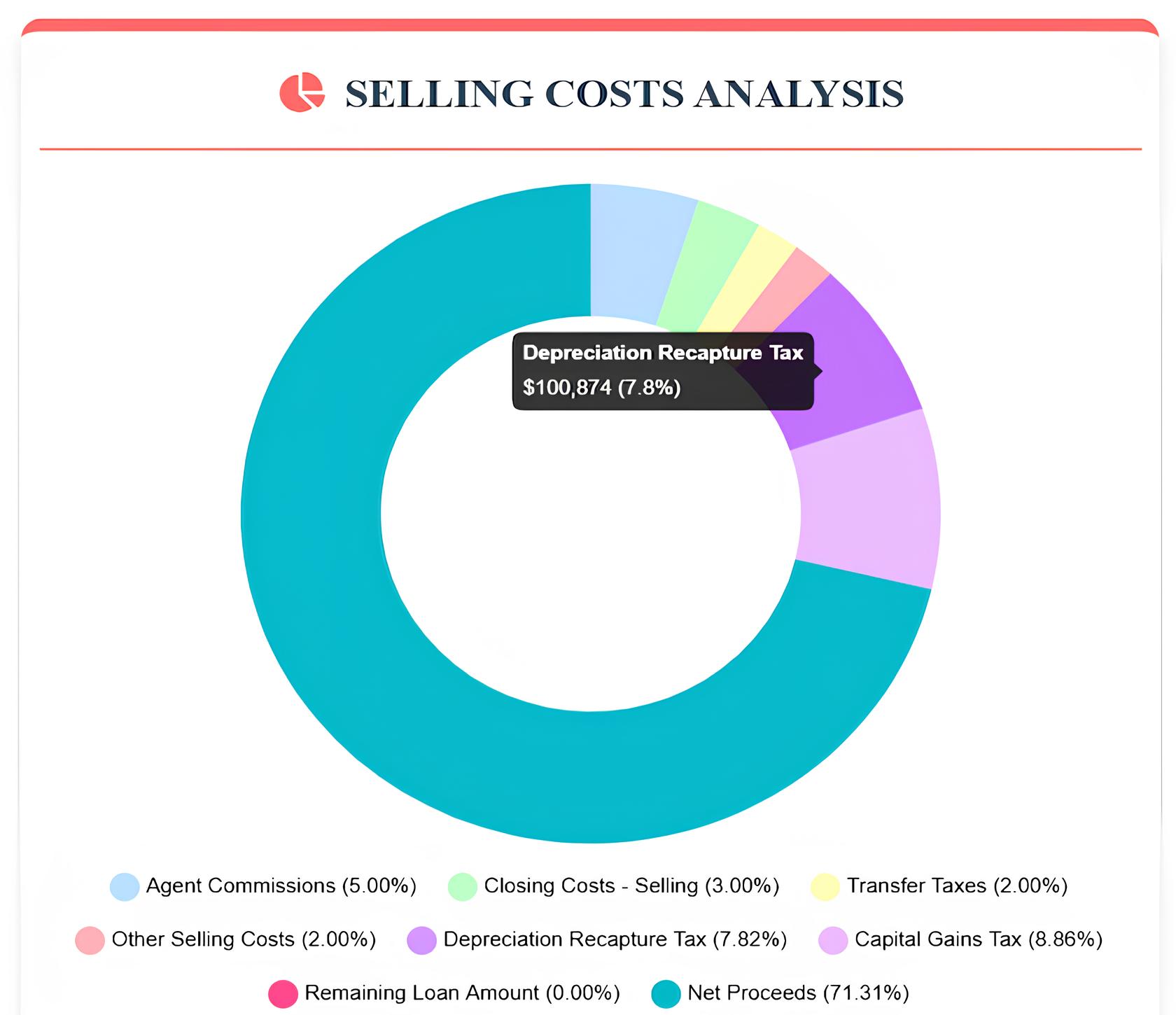

Maximize Returns with Smart Exit & Depreciation Strategies

Understand the financial impact of selling your property with a detailed breakdown of selling costs, including depreciation recapture tax, capital gains tax, agent commissions, loan payoff, and other closing expenses. Compare standard depreciation vs. cost segregation to evaluate their effects on your investment. Explore a detailed breakdown of cost segregation components, including 5-year, 7-year, 15-year, and 27.5-year property categories, to better understand potential tax implications.

Calculate the Right Offer Price for Your Investment

Easily calculate the ideal offer price based on your target monthly cash flow or desired cash-on-cash return. This calculator helps you make data-driven investment decisions by ensuring your purchase price aligns with your financial goals.

Generate Professional Reports & Save Unlimited Property Calculations

Download detailed PDF reports to share with partners or review later. Also, easily save your property calculations on your device and refer back to them anytime to compare different investment opportunities. Save unlimited properties and keep all your analyses organized effortlessly.

of 1

100%

Loading document...